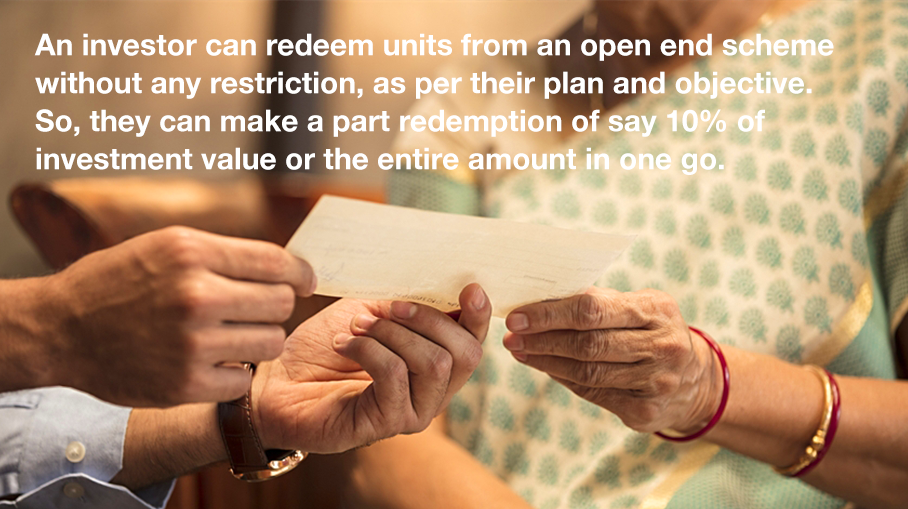

Majority of Mutual Fund schemes are open end schemes, which allow an investor to redeem the entire invested amount without any time restrictions.

Only under few instances schemes impose a restriction on redemption, under extraordinary circumstances, as decided by the Board of Trustees.

All Equity Linked Savings Schemes (ELSS), that offer tax benefits under Sec 80C, are required to ‘lock-in’ investments for a period of 3 years. However, any dividend declared by these schemes during this period is available as a pay out without restrictions. No other category of schemes can impose such a lock-in. Some may impose an exit-load for premature redemptions, to prevent short term investments from entering a scheme. AMCs may specify minimum amounts that may be submitted. All such information is contained in scheme related documents which is important for an investor to read before investing.

Closed end schemes have a fixed tenure and the AMC does not fund or permit any redemption until termination/conclusion date. However, all closed end funds have their units listed in the stock exchange and an investor seeking liquidity needs to sell units to another buyer at a market determined rate.