What are Balanced Advantage Funds?

1min 16 seconds read

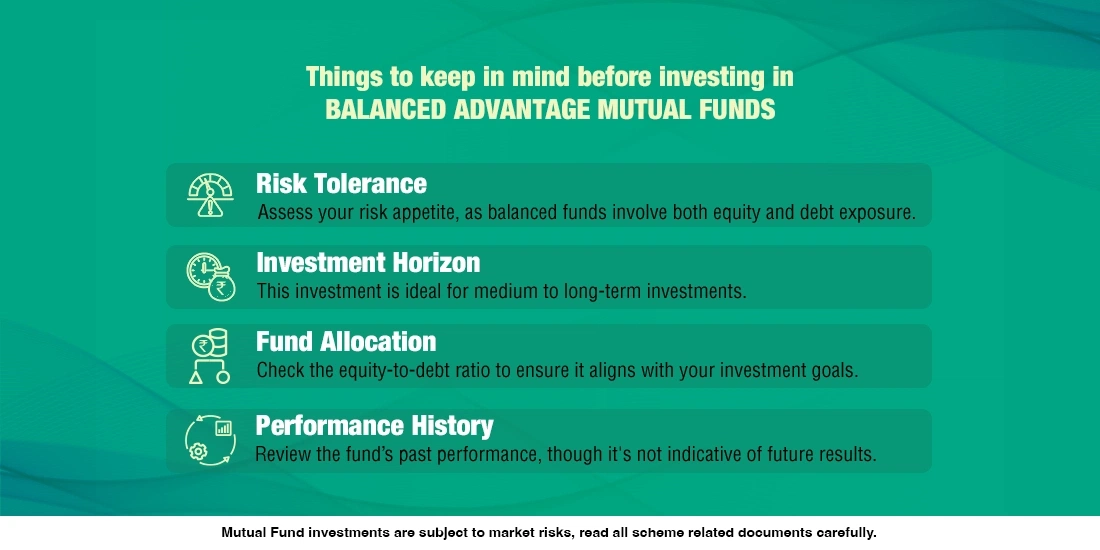

Balanced Advantage Funds, also known as Dynamic Asset Allocation Funds, belong to the category of Hybrid Mutual Funds. These funds invest in both equity and debt without being constrained by a fixed allocation. Fund managers have the flexibility to adjust the allocation between equity and debt based on prevailing market conditions.

Unlike other hybrid mutual funds, Balanced Advantage Funds can dynamically change their mix of equity and debt in response to market fluctuations, subject to scheme offer documents and SEBI (Mutual Funds) Regulations 1996.

The key features of Balanced Advantage Funds are

> Flexible Asset Allocation Funds: These funds actively change their stock-to-bond ratio in view of market conditions and are aggressively managed.

> Lower Volatility: Its diversification into stocks and debt securities ensures some stability during the tides of the market, making these funds less volatile than equity funds.

> Professional Expertise: These are managed by professionals who decide wisely to optimise performance in each dynamic market condition.

> Tax Benefits: These funds get tax benefits in India if at least 65% of the investment is in equities. If the gains from these investments are held for more than one year, it is taxed at 10% if the returns are more than Rs. 1 lakh, and if it is held for less than a year it is taxed at 15%.

> Diversified Portfolio: They diversify by investing in equity and other instruments of debt to propagate less potential for losses from any single investment.

Balanced Advantage mutual funds provide investors with lower risk compared to pure equity funds while helping them achieve their financial goals. These funds are often referred to as all-season funds because of their flexible allocation strategies managed by fund experts.

Disclaimer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.