What are the indicators of risk in a Mutual Fund Scheme?

1min 20 seconds read

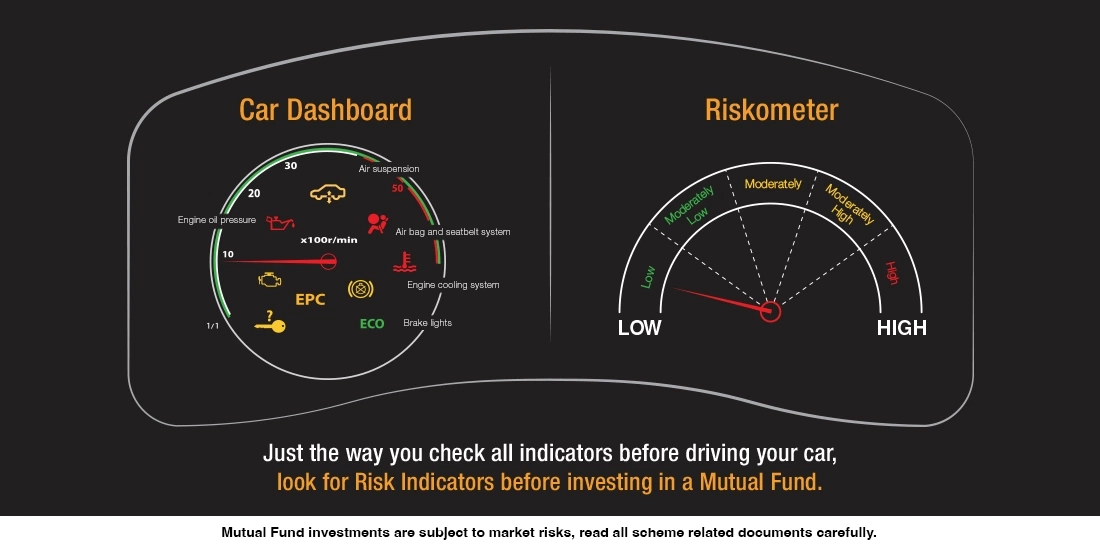

You must properly evaluate before picking up the right Mutual Fund scheme to invest your hard-earned money. While investors often go by scheme category and top performing schemes in the category, they ignore risk indicators for these schemes. When you are comparing schemes to choose from, don’t miss out comparing their riskiness. While there are many risk indicators like Standard Deviation, Beta, and Sharpe Ratio provided in the factsheet of every scheme, product label is the most basic thing to look for. The riskometer in the label shows the risk level of the fund. This riskometer is a mandatory requirement by SEBI and represents the underlying risk associated with the fund. The six levels of risk ranging from low, low to moderate, moderate, moderately high, high, and very high have been linked to various categories of mutual funds depending on the level of risk in their portfolio. Since this kind of risk categorization has been defined by SEBI, all Mutual Funds are bound to categorize similar kinds of funds into the same risk category.

Apart from the riskometer which gives an overview of the fund’s riskiness, one can also look at more specific risk indicators provided in the factsheet. Standard Deviation measures the range of a fund’s return. A scheme with a higher standard deviation of return indicates its range of performance is wide, implying greater volatility.

Beta measures a fund’s volatility with respect to the market. Beta >1 implies the scheme will be more volatile than the market and Beta<1 means it’ll be less volatile than the market. Beta of 1 indicates the scheme will move in tandem with market volatility.

Sharpe Ratio measures the excess return provided by the fund per unit of risk undertaken. It is a good indicator of risk-adjusted return.

Next time you research on which scheme to invest in, don’t forget to evaluate them on the above risk parameters.