Which type of Equity Fund has the lowest risk and which has the highest?

1min 40 seconds read

Mutual Funds are prone to a variety of risk factors depending on categorization and thereby their underlying portfolios. Equity Mutual Funds are prone to many risks but the most significant one is market risk. Equity Mutual Funds as a category are considered ‘High Risk’ investment products. While all equity funds are exposed to market risks, the degree of risk varies from fund to fund and depends on the type of equity fund.

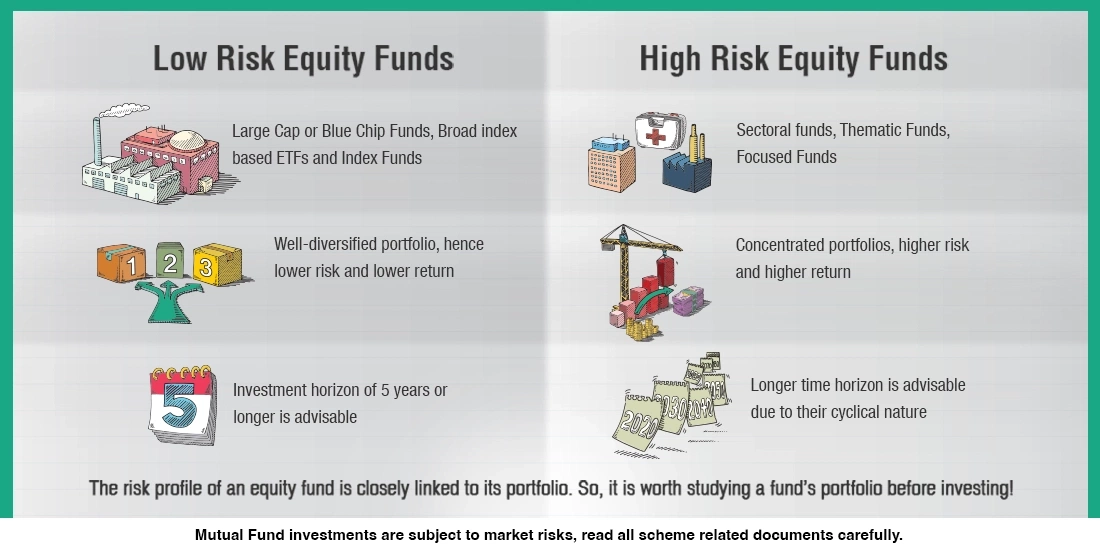

Large cap funds that invest in large cap company stocks i.e stocks of well-established companies with sound financials are considered to be the least risky because these stocks are considered to be safer than stocks of mid cap and smaller companies. Low risk equity mutual funds usually have a well-diversified portfolio that is spread across sectors in the large cap category. Index funds and ETFs based on broad-based market indices that follow a passive strategy are also considered to be low risk as they mimic well-diversified market indices.

Focused funds, sectoral funds, and thematic funds are at the other end of the risk spectrum because they hold concentrated portfolios. High risk equity funds usually suffer from concentration risk due to their holdings that are limited to one or two sectors. Even though focused funds invest in well-known large-cap stocks, they usually hold just 25-30 stocks which increases concentration risk. If the fund manager gets his calls right, he can deliver a higher return than a diversified large-cap fund, but the reverse is also possible.

Sectoral funds invest in stocks of a single sector like auto, FMCG, or IT and hence carry significant risk because any undesirable event affecting the industry will impact all the stocks in the portfolio adversely. Thematic funds invest in stocks of few related industries that are in demand at present but may lose appeal over the longer term.

Investors usually make a generalization that equity funds give a higher return than other funds, but they should be cognizant of the fact that all equity funds are not the same. Return potentials go in tandem with their equity fund risk profile. Hence look for a fund’s degree of diversification across sectors and top holdings for any concentration risk before you decide to invest in it. Instead of looking at funds with the lowest risk or highest return, you should look for a fund with risk levels acceptable to you.