How are Overnight Funds different from Liquid Funds?

56 seconds read

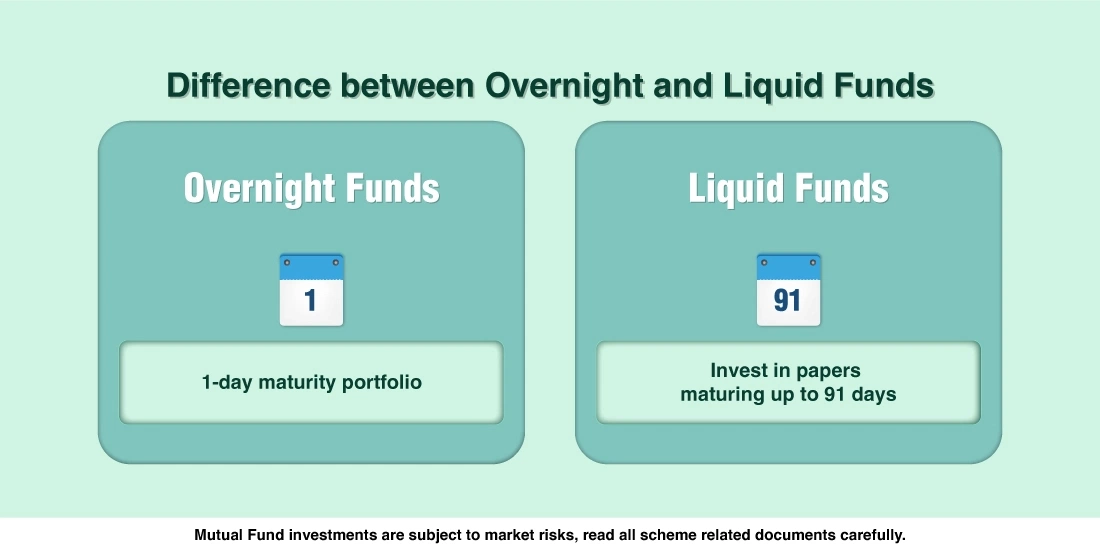

Overnight funds rank a notch below liquid funds amongst debt funds in terms of time horizon and risk profile. Overnight Funds invest in debt securities maturing the next day. Liquid Funds invest in securities maturing within 91 days. Thus, Liquid Funds are prone to higher interest rate, credit and default risk than Overnight Funds since the money comes back to the Overnight Fund the next day when the maturing securities are sold by the Fund Manager.

Overnight Funds are preferable for parking your surplus cash for less than a week as they have no exit load. Liquid Funds have a graded exit load upto six days and no exit load from 7th day. Liquid Funds are free to invest in any money market instruments like CDs and CPs maturing within 91 days irrespective of their credit quality. Thus, they can carry higher credit risk than Overnight Funds.

Since Liquid Funds have slightly more leeway in managing credit risk due to the longer maturity of their portfolio versus that of Overnight Funds, they tend to give higher return than Overnight Funds. If ease of withdrawal is your priority for a need which can arise any moment, Overnight Funds should be chosen. If you are looking for return while parking your surplus cash for over a week, Liquid Funds may be chosen.