How Safe are Overnight Funds?

56 seconds read

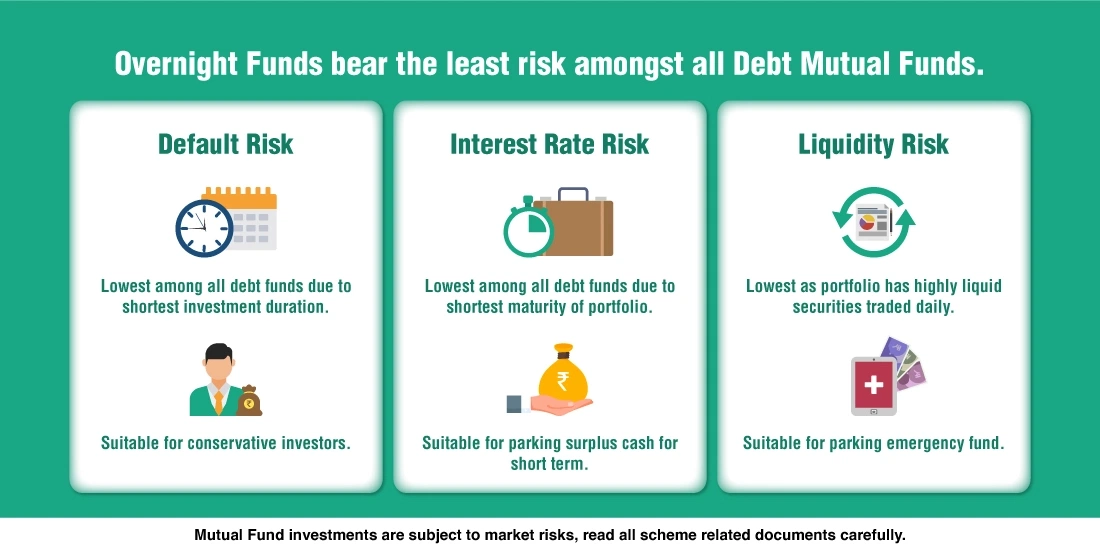

If you are looking for a Mutual Fund that has no risk of loss, there aren’t any! All mutual funds are subject to some risk factor or the other. While Equity Mutual Funds are subject to market risk, debt funds are subject to interest rate risk and default risk. Amongst the debt funds, the degree of risk is different depending on the average maturity of the portfolio. Longer the maturity of a debt fund’s portfolio, higher is the interest rate risk and default risk.

Overnight Funds are a kind of debt fund that invest in debt securities maturing the next day. Hence these funds have the shortest maturity amongst all debt funds. Thus, they carry the least interest rate risk and default risk. While we can’t assume that Overnight Funds have no risk attached to them, it is safe to assume that they have the least risk amongst all funds put together. Hence, they are considered ideal for parking large sums of cash for a very short period by taking the least risk when the sole purpose is to ensure the capital is safe without much expectation for returns.

Overnight funds are suitable not only for larger institutions that have large sums of cash but also for small investors who want to invest their liquid money for a short period.