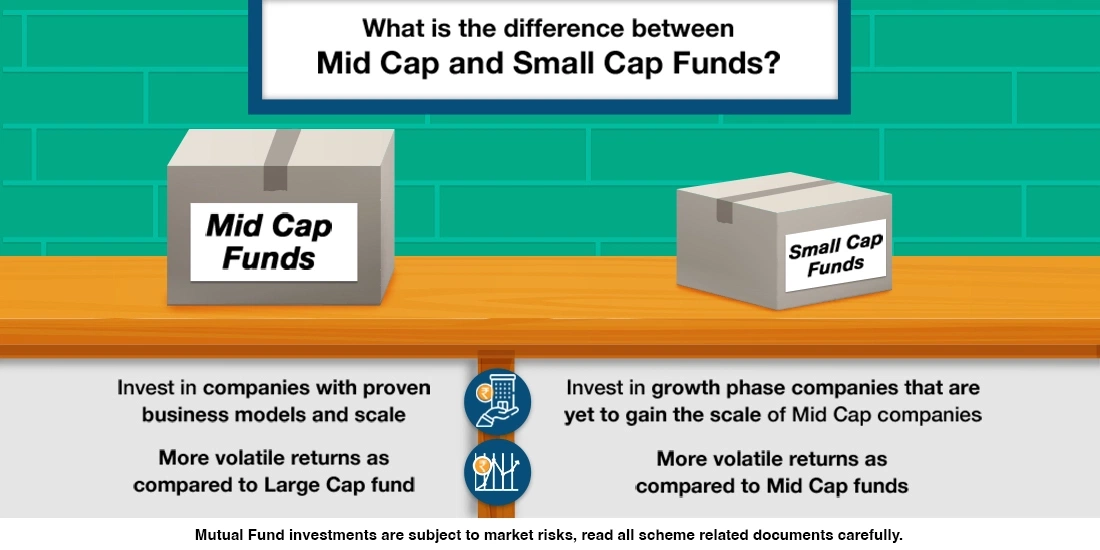

What is the difference between Mid-cap and Small-cap Funds?

1min 38 seconds read

If you have been wondering whether mid-cap and small-cap funds are one and the same thing, you should definitely refer to SEBI’s product categorization circular issued in Oct 2017 that came into effect in June 2018. These are two different types of equity mutual funds that invest in different kinds of companies, as defined by their market sizes, and hence exhibit different risk-return profiles.

There are many publicly listed companies on various exchanges in India. Mid-cap refers to the 101st to 250th company in terms of market capitalization (market capitalization = no. of publicly listed shares * price of each share) while 251st company onwards in terms of market capitalization are called small caps.

A Mid-cap fund invests in mid-cap companies that have high growth potential but don't exhibit the risk associated with small caps since these companies have already attained a certain scale and stability. You can read more about mid-cap mutual funds in one of our articles:

mutualfundssahihai.com/en/what-are-mid-cap-funds

A Small-cap fund invests in small-cap companies that are currently going through a high potential growth stage but are equally risky. Unlike the more stable large-cap stocks, small-cap stocks can be far more volatile.

So mid-cap funds have the potential to offer higher returns than large-caps without being too risky like the small-cap fund category. But they still have some element of risk that is higher than those of large-cap funds.

Given the kind of stocks they invest in, both midcaps and small cap funds are risky in the short to medium term. These funds are suitable for young investors in case they wish to plan for their long-term goals like retirement, child education etc since they can afford to bear the volatility of these fund in the 5-7 yrs horizon. The reason for this volatility is that unlike bluechip stocks, the stocks in the portfolio of these funds are still in the initial growth phase and haven’t reached the stable growth phase of bluechip stocks.

But that doesn’t mean all young investors in their 20s or 30s need to have these funds in their portfolio. A young investor with moderate to high risk aversion should avoid these and instead stick to the more stable large-cap funds or explore multicap funds that have exposure to large caps, midcaps and small caps in the same proportion.