How should one choose the right type of equity fund for investment?

1min 28 seconds read

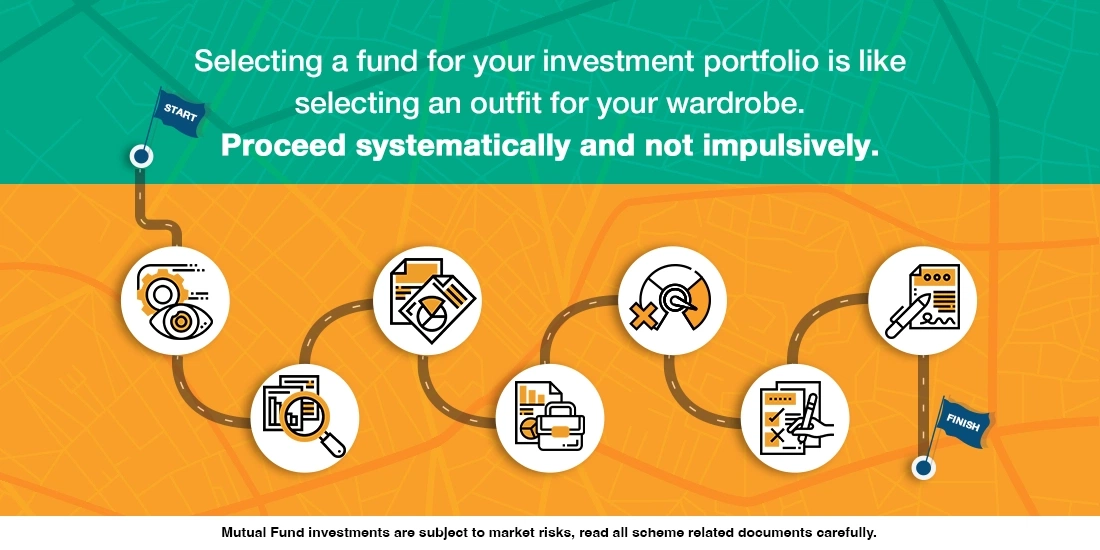

Choosing an equity fund for your investment portfolio is like choosing an attire, though the decision-making process is more complex in this case. Just the way you look at a shirt or dress in detail, how well it fits you, the comfort, will it serve the purpose or occasion for which you are buying the outfit, choosing an equity mutual fund for your portfolio requires a similar approach, to put it in simple words.

Before you go shopping for an equity fund investment, you need to look at your existing investment portfolio. What kind of investments do you already have just like what kind of clothes you already have in your wardrobe and what’s missing from it? You may already be having some equity fund investments or don’t have any exposure to equity as an asset class. Hence the next equity fund you pick should fill the current gap in your overall investment portfolio. For instance, if you have already invested in a diversified equity fund, you may consider a different type of equity fund that suits your risk preference and investment goal like say Multicap or mid-cap fund. It could also be a tax saving fund if your goal is to save tax and you don’t hold such a fund in your portfolio. You need to spread your equity asset class risk through diversification across different types of funds.

The next thing to look for is what the fund looks like in terms of its investment objective, portfolio in terms of sector and stock holding, fund managers, vintage, risk parameters, expense ratio, etc. This is like looking for the style, colour, fabric, and finish of the outfit you want to buy. Then you assess if the details suit you just like the fit of an outfit. The fund must suit your requirement or goal you have in mind. At this point, you may look at its performance track record w.r.t its benchmark.

Next time you want to invest in a fund, follow the above selection approach systematically or reach out to a financial expert for help.