What information and risk parameters should one consider before investing in an equity fund?

1min 52 seconds read

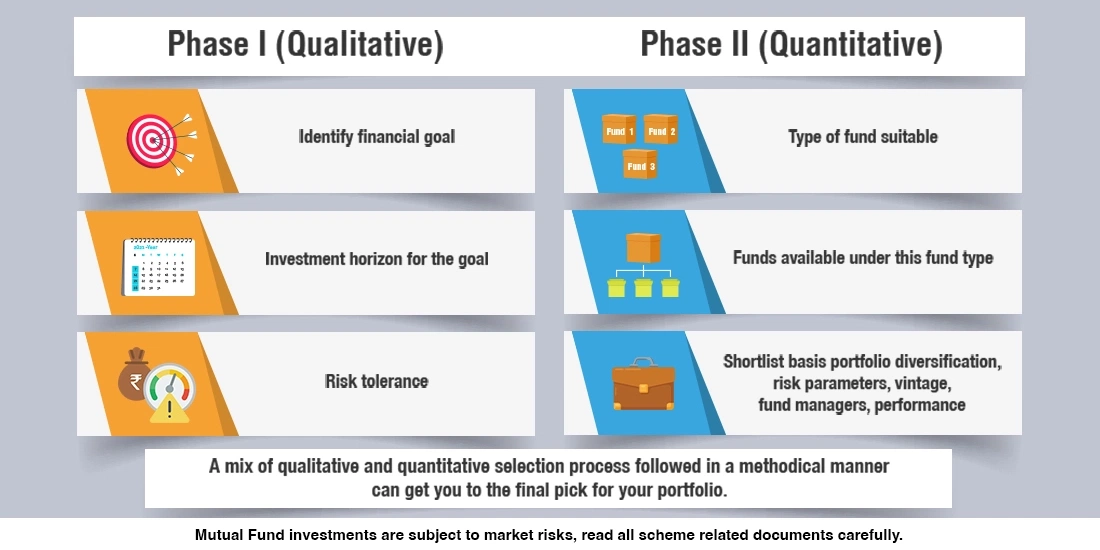

Choosing an equity fund for your portfolio requires a methodical selection process that has two phases. The first one is about you and begins with identifying the need for an equity mutual fund in your portfolio or your financial goal along with its time horizon the type of equity fund investment, and an assessment of your risk tolerance. Once these three things are in place, selecting the suitable fund amongst those available is the next step in the process i.e. second phase.

The second phase thus involves searching through all the suitable funds using a more qualitative approach by looking for certain information on the funds and analyzing various risk parameters. You should look for information on fund portfolio, vintage, fund managers, expense ratio, its benchmark, and how the fund has performed w.r.t its benchmark over time.

When you look at the portfolio, see how diversified it looks in terms of sector allocation and stock selection. This can be gauged from the fund’s top 10 sectors and stock holding. When you look at vintage, it gives you an idea of how many economic cycles has the fund weathered. During a bull run, most funds do well but how do funds perform through a complete cycle of bull and bear market phases is an indicator of the portfolio’s resilience. Fund manager’s track record is closely linked to the fund’s vintage. You can look at the other funds managed by the fund manager to get a better view of his/her track record.

Expense ratio is an important indicator of how well the fund is being managed operationally which is different from fund performance. Lower the expense ratio, the better it is for an investor.

Next, look at key equity fund risk indicators like standard deviation and beta. The former gives you an idea about the fund’s volatility in returns or fluctuations expected in its returns. Higher standard deviation implies you can expect more volatility in the fund's returns i.e. the return is likely to fluctuate more both ways (positive and negative) from the fund’s average expected return. Beta is an indicator of the fund’s sensitivity to market movements. Beta >1 implies the fund’s NAV is more sensitive to market movements. Hence the fund will rise more than the market during up market phases and also fall more than the market in down market phases. Beta =1 implies the fund’s NAV will move closely with market movement. Low risk equity mutual funds usually have Beta <1.

Spend some time yourself or seek guidance from a financial advisor on gathering information on funds and analyzing them before you make the final selection for your portfolio.